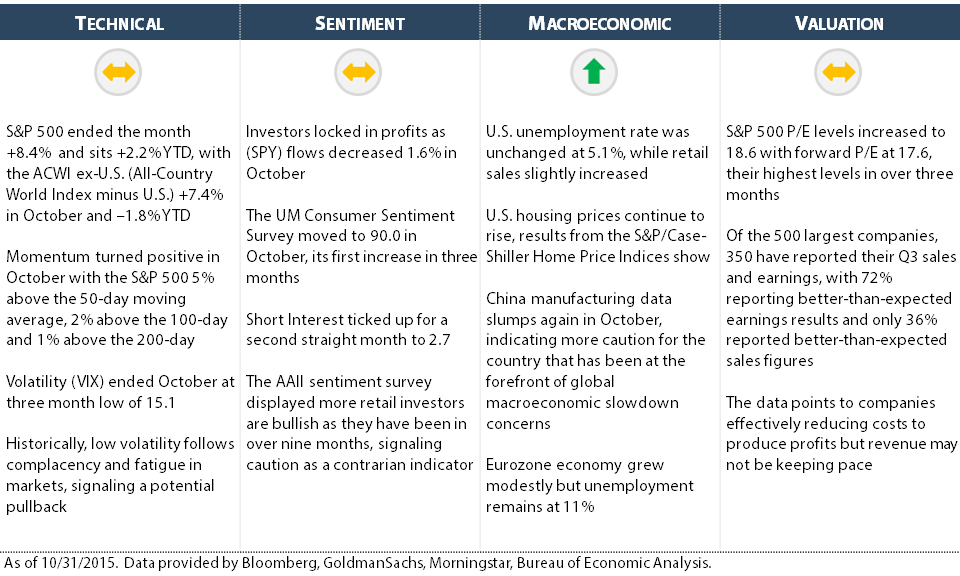

Global stocks regained footing in October with the S&P 500 rallying +8.4% and the All-Country World Index ex-U.S. (ACWI ex-U.S.) adding 7.4%, their largest monthly gains in four years. Much of the gain can be attributed to the overreaction to market sell-offs in August, coupled with central banks reaffirming enhanced stimulus efforts to bolster global markets. The Federal Reserve did not raise interest rates during its recent gathering while European Central Bank leader Mario Draghi signaled the bank is prepared to undertake another large stimulus package. The actions of central banks are evidence of slowdowns (or at least concern) in global economic growth, specifically emerging markets.

Global stocks regained footing in October with the S&P 500 rallying +8.4% and the All-Country World Index ex-U.S. (ACWI ex-U.S.) adding 7.4%, their largest monthly gains in four years. Much of the gain can be attributed to the overreaction to market sell-offs in August, coupled with central banks reaffirming enhanced stimulus efforts to bolster global markets. The Federal Reserve did not raise interest rates during its recent gathering while European Central Bank leader Mario Draghi signaled the bank is prepared to undertake another large stimulus package. The actions of central banks are evidence of slowdowns (or at least concern) in global economic growth, specifically emerging markets.

NorthCoast maintained sizable equity positions in its tactical strategies throughout August and September. Its flagship strategy, CAN SLIM®, was 85% invested prior to the October rally. During the market advance, the strategy raised cash capitalizing on recent gains and selling some positions. Valuation in stocks became less attractive throughout the rally and a pivotal earnings season will determine if the current valuations are warranted.

October’s gain wiped out the losses created in August and September, resetting stocks to a “wait-and-see” status pending 3rd quarter earnings and central bank decisions. In a more defensive posture than usual, NorthCoast stands in position for some market weakness and will seek new opportunities if the data signals future growth.