Increased oil production growth globally and the rise of shale in the U.S. has led to the oversupply in the oil & gas industry dragging down oil prices.

Oil prices have seen a precipitous decline in the recent months from nearly a $100 per barrel of crude to $55 per barrel. This is compared to an average price of $80 per barrel over the past 10 years. Markets have experienced similar sharp declines in oil prices during 1986, 1991 and 2008 and the recovery has been slow in each of these cases, usually over the course of several quarters.

Our models incorporate the volatility in oil prices in several ways such as stop losses, risk management, and in our cash scaling model which measures the market environment across technical, macroeconomic, sentiment and valuation factors which are impacted by volatility in oil prices.

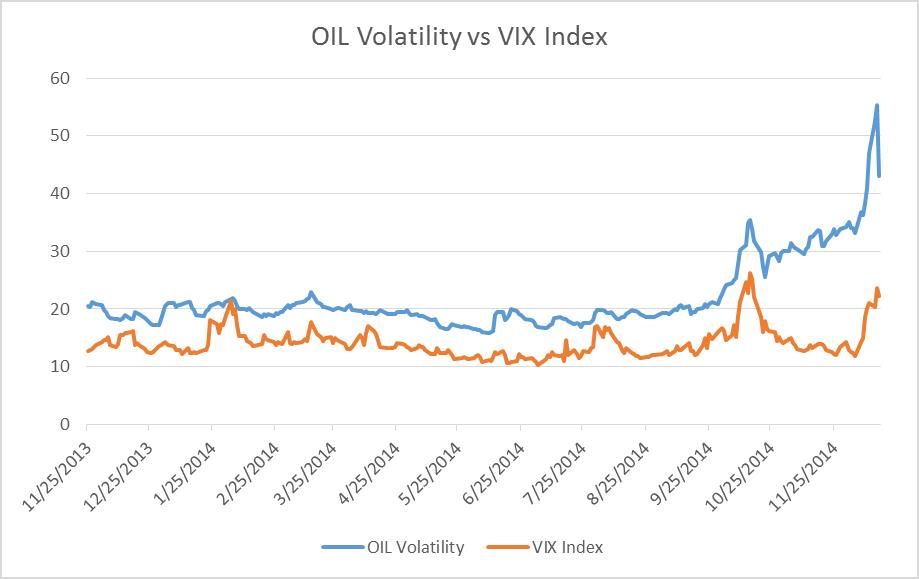

For example, the recent slide in oil prices has led to a rise in the VIX index which is a measure of the market volatility. Cheaper oil & gas prices should aid to lower consumer prices, therefore resulting in increased consumer confidence. With oil prices at the lowest levels since 2009, capital spending projections in the oil & gas sector are being revised downwards, which would have an impact on the industrial production data. The impact of sharp decline in oil prices on macro-economic data is yet to be seen over the next few quarters.

We are constantly monitoring the events occurring in the market as a result of the slide in the oil prices and their impact on our portfolios, while paying close attention to any signs of recovery.