What happened in September?

September by the numbers:

U.S. Equities | S&P 500: 1.8%

International Equities | ACWI ex-U.S.: 2.6%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.5%

Global Bonds | JP Morgan Global Aggregate Bond Index: -1.0%

Moving into October

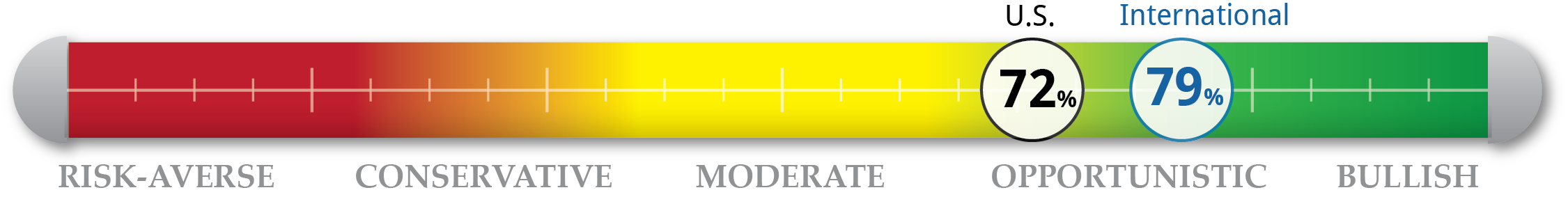

Not only will October bring fresh Federal Reserve speculation and finally a decision, but also the continuation of U.S. and China trade talks. Excluding political controversy and headlines, September saw little in the way of drastically market moving headlines relative to August. However, it is possible that next month is set to reignite some volatility driving events. Third quarter earnings and economic data due to be released during the month will provide a clearer picture of U.S. equity and economic health as well as insight into the Fed’s decision. Our indicators are showing only minor changes from last month in the U.S. and some improvement abroad. We are 72% invested in our domestic tactical strategy and 79% in the international tactical strategy.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation With the S&P 500 closing in on its all-time high set back in July, valuations indicators are still negative and equity prices still elevated. Earnings reports will shed more light on U.S. companies’ earnings. P/E ratios sit at approximately 19.6. |

Sentiment The University of Michigan consumer sentiment survey rose almost 4% month-over-month to 93.2. This modest change does little to move the overall indicator, which has stayed relatively in line with last month. Depressed energy prices do sometimes inflate the surveyed numbers.

|

Macroeconomic Macroeconomic indicators are still positive this month. Consumer spending slowed slightly, but homeowners saw a mild uptick in housing prices. Data released last month showed that U.S. household net worth growth was still modestly positive in the 2nd quarter, though below 1st quarter’s growth rate. |

Technical With the rebound in U.S. equities, the S&P 500 reverted back above the 50-day moving average and sits further above its 100- and 200-day moving averages. The relative strength index, measuring momentum, ticked slightly higher due to the positive month. Market volatility, measured by the VIX, came down to July’s levels around 16.

|