NorthCoast Navigator

January 2015

For a sixth consecutive calendar year, U.S. equities closed in positive territory. The S&P 500 ended 2014 +13.0% (including dividends), the third straight year of double-digit gains.

Positive macroeconomic data in the U.S. propelled stocks throughout 2014. Increasing GDP growth, positive job growth, decreasing unemployment and confidence in the economy from the Federal Reserve to end Quantitative Easing all contributed to the positive movement.

Much of the concern and many of the 2014 market pull-backs were caused by instability and geopolitical factors outside the United States. A weakened recovery in Europe, slow growth in Emerging Markets including China, and political tensions with Russia caused international equities to fall in 2014 with the ACWI ex-US (All-Country World Index excluding U.S.) ending the year -3.9%, an almost 17% difference from the S&P 500. Heading into 2015, many of the same themes exist. Positive momentum in the U.S. and uncertainty globally guide the investment decisions.

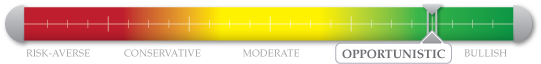

NorthCoast remains cautiously bullish or "Opportunistic" in this environment, with our tactical portfolios between 85%-90% equity invested.