President & CEO Dan Kraninger reflects on a volatile 3rd quarter and provides insight moving forward

“The cave you fear to enter holds the treasure you seek.” - Joseph Campbell

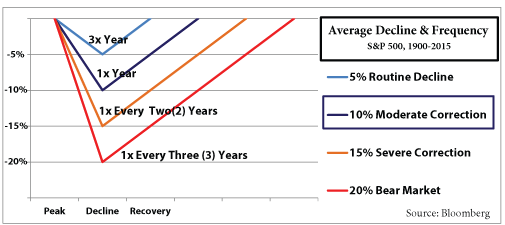

Below is a depth and frequency chart displaying stock market declines over the last 115 years. I’d be willing to bet almost every investor has seen it at some point in their life. It is standard industry fare that we even include in our investment advisory agreement that every one signs upon becoming a client.

Why is it then that people seem so surprised when the market declines 10%? We know, based on historical data, it is going to happen about once every year. Essentially the same frequency as Thanksgiving... an event in my home that we seem to prepare for months in advance. The only difference is we don’t know when market corrections will start and end -- there are no warning or “all clear” bells that ring. The key to successful investment management is differentiating between 10% corrections and bad bear markets - something our firm has done a very good job of over the years. If an investor moves to cash in every 10% decline, he or she will never make equity like returns over time (~10% a year). In fact, in some markets, he or she will create an unnecessary loss by selling at a low (i.e. 2011). Instead, remember that people (institutional and retail alike) get scared and short term price movements in the market often reflect that fear. A decline in stock prices when valuations are reasonable and the economy is growing should be viewed as a buying opportunity. But declines when valuations are high and the economy is weak are a signal to raise cash and avoid. Based on our research, this market displays the former.

Don’t fear declines. They are part of the market fabric. Instead, be prepared. From our perspective, this is a time to add to your account. Declines like this happen almost every year, just as Thanksgiving and taxes . . . try to embrace them. Understandably embrace these declines more like “tax day”, because even though I know its coming, I still don’t enjoy it.

The Plan Moving Forward?

- As always, allow data & discipline to drive our decisions

- Liquidate positions when the risk outweighs the future return potential

- Strategically increase market exposure with positions displaying the most attractive return/risk ratio

- Continue to monitor the market and adjust accordingly