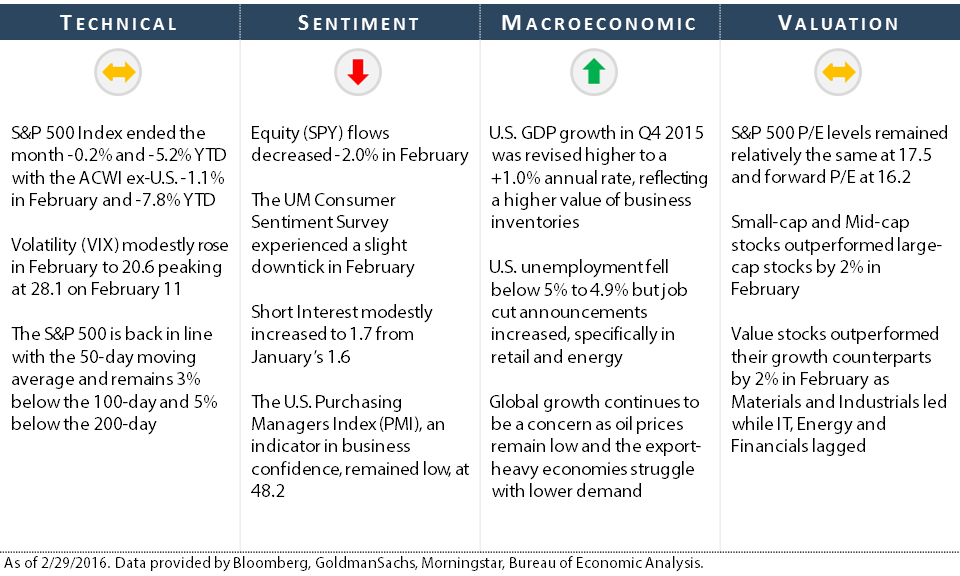

After declining almost 6% to start February, the S&P 500 index has rallied over 7% since February 12 to finish the month nearly flat at -0.2% return. The index remains negative for the year at -5.2%.

Much of the fear and uncertainty that “strong-armed” equities in January has temporarily subsided.

Major oil producers around the globe continue to seek agreements in limiting supply to increase prices

Chinese equities remain in a correction but have stabilized over the last few weeks

The Federal Reserve has indicated a possible delay in additional increases to lending rates

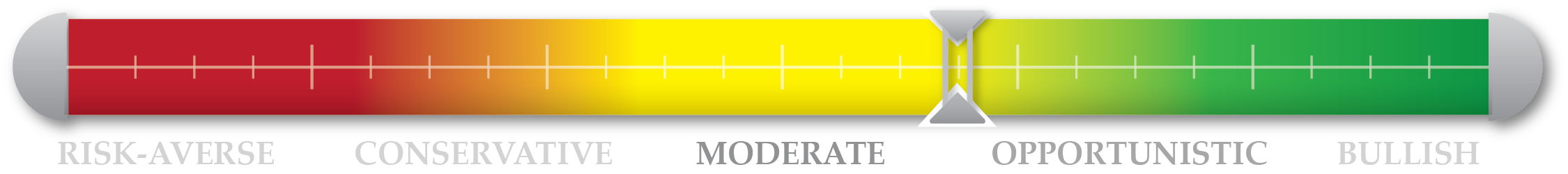

Throughout January and early February, we remained committed to a bullish outlook with our tactical investment strategies holding between 90%-100% exposure to equities. This proved fruitful as the recent rally lifted portfolio performance. As the rally continued, we reduced exposure as key indicators pointed towards a more conservative stance, particularly with sentiment.

Consumer sentiment, producer sentiment, and economic surprise indices weakened in February

Macroeconomic signals slightly decreased driven by weaker job market data

Valuation indicators decreased as stock prices rose, diminishing the appetite for high-priced stocks

We ended the month with 65% equity exposure in our U.S. tactical strategies and 85% in our international portfolios. The 35% cash hedge in the U.S. is primarily attributable to valuation and sentiment metrics which weakened as the market pushed higher at month end.