What happened in March?

March by the numbers:

U.S. Equities | S&P 500: 1.9%

International Equities | ACWI ex-U.S.: 0.6%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: 1.9%

Global Bonds | JP Morgan Global Aggregate Bond Index: 1.6%

Moving into April

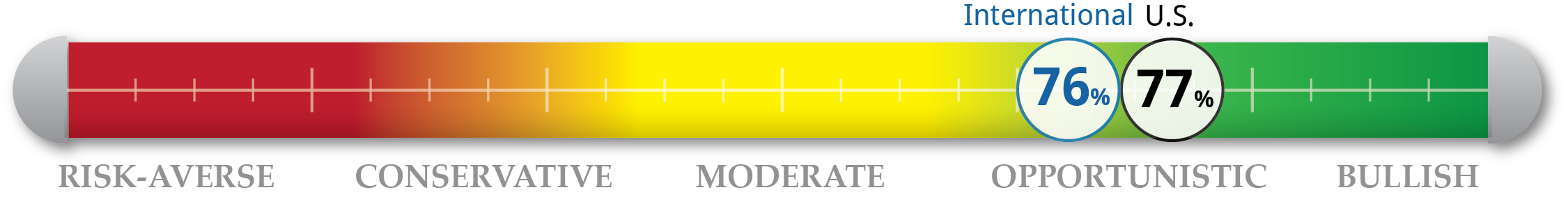

With so much attention on the Federal Reserve, equities may have unexpected reactions to both positive and negative news. Investors may have to keep in mind the impacts of slowing growth versus rising interest rates. Economic data pointing to possible slowing growth could actually bolster stocks because the possibility of near-term rate increases would become less likely. We have been monitoring this development for a long time to understand all of its impacts independent of the implications on rate policy. At the end of Q1 we sit 77% invested in our domestic tactical strategy and 76% in the international tactical strategy. We feel confident with the room to increase exposure in the case of more positive data in the coming weeks and months, and to scale to more cash should the data turn more negative.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

|

Positive Indicators |

|

Valuation Valuation indicators remain negative after more positive price action in March. P/E ratios are hovering around the same levels as February. The recovery from the losses at the end of last year has brought prices back to elevated levels similar to September of 2018. |

Macroeconomic Macroeconomic indicators moderated slightly in March. Data released last month showed that personal consumption expenditure rose by less than anticipated in January. Inflation also appears to be lagging behind the Federal Reserve’s 2% target. The government shutdown in December and January may have impacted some data. |

Sentiment Sentiment indicators continued their modest recovery in March. The University of Michigan Consumer Sentiment Survey rose almost 5 points to 98.4. Investment flows into the SPY ETF were positive again last month. Lowered mortgage rates could see an uptick in housing sales. |

Technical A positive March and first quarter boosted major stock indexes above their long term averages. The S&P 500 sat 3% above its 200-day moving average at the end of last month. Volatility also lowered slightly with the VIX moving from 14.8 to 13.7 on 3/31/2019. |