NorthCoast Remains Bullish Entering 4th Quarter

What happened in September?

What happened in September?

Global equities spent the 1st half of September in a gradual decline as a pending interest rate increase from the Federal Reserve appeared forthcoming. With macroeconomic data displaying a stable, growing economy, regulators have been seeking an opportunity to increase the rate at which institutions borrow money. However, the decision was made to keep interest rates in place. Since then, equities gained to close the month with positive momentum heading into 4th quarter.

NorthCoast Increases Equity Exposure Throughout Quiet August

What happened in August?

What happened in August?

NorthCoast Reduces Equity Exposure as Valuations Stretch

What happened in July?

What happened in July?

NorthCoast Stays the Course throughout Brexit Turmoil

What happened in June?

What happened in June?

On June 23, U.S. stocks were approaching new highs and on a trajectory to close the quarter and year-to-date in positive territory. Later that evening, citizens in Great Britain voted to remove their country from the European Union (EU), a politico-economic union of 28 nations.

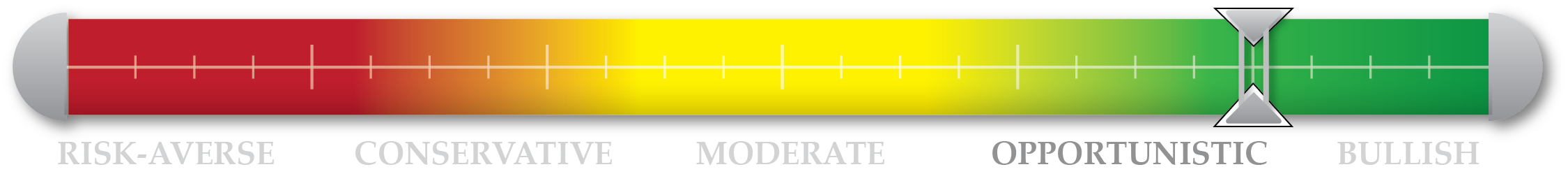

Macroeconomic and Technical Indicators Drive Opportunistic Position

U.S equities advanced over the final two weeks of May, temporarily dispelling the myth, “sell in May and go away”. The S&P 500 Index increased +1.7%, while the Russell 2000 Index moved +2.2%. The S&P 500 Index now sits +3.3% YTD heading into June. The boost in U.S. equities coupled with positive macroeconomic data has reignited speculation of another rate hike by the Federal Reserve. The U.S.

U.S equities advanced over the final two weeks of May, temporarily dispelling the myth, “sell in May and go away”. The S&P 500 Index increased +1.7%, while the Russell 2000 Index moved +2.2%. The S&P 500 Index now sits +3.3% YTD heading into June. The boost in U.S. equities coupled with positive macroeconomic data has reignited speculation of another rate hike by the Federal Reserve. The U.S.

NorthCoast Remains Cautious Heading into Q2

U.S. equities (S&P 500) opened the year with an almost 6% decline in January, remained flat with a down-then-up February, and have since rallied over 6% in March to end the quarter +1.2% YTD. International equities (ACWI ex-U.S.) experienced even greater gains in March with a +8.1% return, paring earlier losses and sit -0.4% YTD.