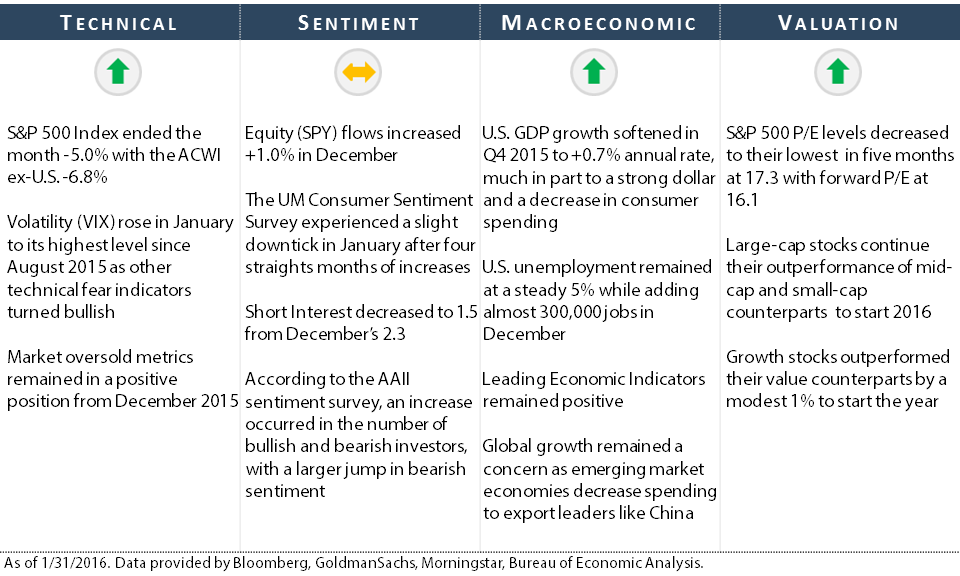

Stocks experienced their worst January since 2009 as U.S. equities (S&P 500) fell -5.0% while international equities (ACWI ex-U.S.) dropped -6.8% during the month. Global growth concerns (particularly in China), a continued decline in oil prices, and uncertainty in central bank action were believed to be the main drivers behind the weak start to 2016.

Stocks experienced their worst January since 2009 as U.S. equities (S&P 500) fell -5.0% while international equities (ACWI ex-U.S.) dropped -6.8% during the month. Global growth concerns (particularly in China), a continued decline in oil prices, and uncertainty in central bank action were believed to be the main drivers behind the weak start to 2016.

10% market corrections are natural and typically occur during points of uncertainty and fear, which tend to accelerate the volatility. Consider this statistic of last month’s swings: of the 19 trading days in January, 13 (almost 70%) experienced moves of +/- 1%, five of which experienced moves +/- 2%. We experienced similar action in August 2015 and October 2014, in which both occurrences lead to new market highs.

NorthCoast began the year with approximately 30% cash in many of its U.S. tactical strategies. As the decline began, our outlook turned bullish with macroeconomic, technical and sentiment indicators remaining bullish and valuation turning positive, thanks to the drop in prices. On January 15, as equities began the year down almost -9%, we published the following communication indicating our bullish outlook (click here to read the report). Since that publication, U.S. equities have bounced over +3%. A move to cash at the recent low, as many technical indicators may have signaled, would have cost investors. As the month continued, a few positions were liquidated as they reached designated sell-stops and their outlooks turned unattractive.

We enter February approximately 85% invested with an opportunistic outlook. We will keep a close eye on the remainder of earnings season.