What happened in June?

After a strong start to the month, equities fell in the latter half but hung on to finish June in positive territory. Solid U.S. economic data, including a healthy jobs report, GDP growth projections, strong consumer spending, and easing geopolitical tensions allowed U.S. equities to rally +3.0% between June 1-12. However, the tide quickly turned as U.S. tariffs on steel and aluminum resulted in retaliatory tariffs from the Eurozone and China. It was announced that Harley-Davidson, the U.S.-based motorcycle manufacturer, will be shifting production overseas to avoid the E.U tariff placed on its product. The combined macroeconomic and sentiment concerns pulled U.S. stocks -3.0% from June 13-27 before rallying over the last two sessions to finish the month in positive territory.

Across the globe, international stocks closed negatively for the month and are now -10.1% from their 2018 high on January 26. Among the issues, decreasing industrial output in the Eurozone could slow economic growth in the region while financial markets in China struggle due to increasing trade tensions along with the continued attempt to deleverage.

May by the numbers:

U.S. Equities | S&P 500: +0.6%

International Equities | ACWI ex-U.S.: -1.9%

U.S. Bonds | Barclays U.S. Aggregate Bond Index: -0.1%

Global Bonds | JP Morgan Global Aggregate Bond Index: -0.3%

Moving into July

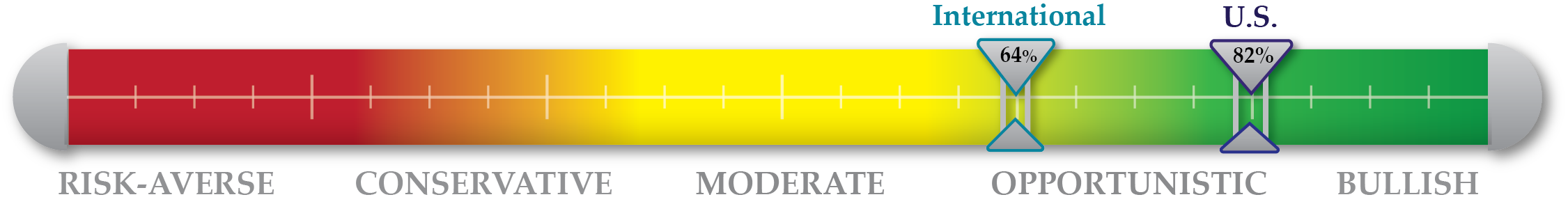

Overall, macroeconomic and sentiment indicators remain bullish. Sentiment data provides a cautiously optimistic stance as U.S. consumers, now with reported higher wages, are more upbeat about their current financial situations. Alternatively, the U.S. administration’s additional tariffs on China has raised trade concerns which could increase uncertainty and dampen the collective consumer and producer sentiment. Internationally, souring investor sentiment in emerging markets and the Eurozone is prompting more cautious economic behavior. We enter July 82% invested in our U.S. tactical strategies and 65% invested in our international tactical strategies.

NorthCoast Navigator

|

Negative Indicators |

Neutral Indicators |

Positive Indicators |

|

|

Valuation Valuation indicators were unchanged in June. The average P/E and forward P/E ratios of S&P 500 companies ticked slightly higher to 20.7 and 17.1 respectively. |

Technical The relative strength index, measuring general market momentum, slightly fell in June but the end-of-month decline provided a near-term buying opportunity. The general market index is 2% above its 200-day moving average. |

Sentiment The University of Michigan Consumer Sentiment Survey was relatively unchanged at 98.2. Flows into the S&P 500 equity fund SPY were negative with the increased volatility in the market. |

Macroeconomic U.S. inflation hit a 6-year high in May at 2%, a key metric showing the growing economy is on healthy trajectory. Unemployment rate dropped to 3.8%, an 18-year low. |