Bracing During the Pandemic's Peak

During the month of March 2020 the Coronavirus pandemic and its immense economic impacts have brought about some of the most volatile market trading in history. The S&P 500 came down almost 34% at the close of March 23 from its high on February 19. What’s most notable about this drop is the unprecedented speed at which it occurred: just 23 trading days. The average daily move during this 23-day period was 4.2%, with an average of 4.9% during the entire month of March. There is little if not zero modern historical context for this event. However, data from previous market declines such as occurred in 2000-2001, 2008 and even from the last pandemic in 1918 will still be able to provide valuable insight to our management team.

As we have stated in our communications throughout this period (links below for reference), this unconventional crisis continues to cause unconventional market action. Not merely an isolated cause/effect, the health emergency has caused an economic slowdown and liquidity crisis that ripples across global markets. JNJ and several other pharma companies are fast-tracking vaccines and treatments that have the potential to alleviate pressures on our healthcare system. The passage of the $2.2 trillion stimulus bill for businesses and individuals has improved the economic outlook. Additional spending bills may follow. Market indicators are generally lagging, but the Federal Reserve is attempting to bolster the economy as quickly as possible with new, more frequent measurements and actions. This will help us incorporate data more quickly into our models moving forward. Regarding liquidity, the Fed has pledged essentially unlimited buying of assets normally on its balance sheet as well as expanded purchases of other asset classes. These moves and the relative easing of the selling have significantly improved liquidity issues.

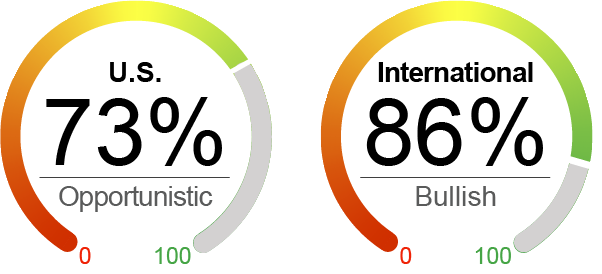

At NorthCoast, we continue to use volatility to exit certain positions and refresh some allocations in both our domestic and international equity strategies. The U.S. equities rally at the end of the month was encouraging and we are comfortable that with our current 73% exposure we are positioned well for whatever is to come. Upcoming earnings and economics reports will continue to cause market volatility. These figures may cause more sector-specific moves, or may drive market-wide action. We are adapting to this situation as quickly as it is evolving.

We want you to know that we are here to help in any way possible and that we are keeping all of you and your families in our thoughts. The fight against Covid-19 continues and we at NorthCoast hope that you and your families are safe and healthy.

By the Numbers*

U.S. Equities (S&P 500 Index) | -19.7%

International Equities (MSCI ACWI ex-U.S.) | -23.4%

U.S. Bonds (Barclays U.S. Aggregate Bond Index) | 3.2%

Global Bonds (JP Morgan Global Aggregate Bond Index) | -0.3%

The NorthCoast Navigator is a market "barometer" displaying NorthCoast's current U.S. equity outlook. This aggregate metric is determined by multiple data points across four broad market-moving dimensions: Technical, Sentiment, Macroeconomic, and Valuation. The daily result determines equity exposure in our tactical strategies.

As of 3/31/2020. Data provided by Bloomberg, NorthCoast Asset Management.

*Source: Bloomberg, NorthCoast Asset Management.

|

Positive Indicators |

Neutral Indicators |

|

Negative Indicators |

|

Valuation With the market downturn, valuation indicators have improved. P\E ratios have come down for S&P 500 companies, but new earnings data forecasts to come for Q1 2020 will yield more accurate multiples. |

Sentiment Sentiment indicators have worsened as is to be expected. Rates of consumers saving is likely to increase and the University of Michigan Consumer Sentiment Survey dropped to 89 from roughly 100. |

Macroeconomic Weekly jobless claims gained a lot of attention towards the end of month and for the moment, joblessness is going to increase. GDP growth projections have been lowered. Fast action from the U.S. and international governments will hopefully buoy parts of the economy. |

Technical The speed and severity of the downturn caused for deterioration of technical indicators. The volatility index, VIX, spiked to all-time highs and settled down to just above 50 at end of month. Momentum indicators have softened and the S&P 500 sits below its moving averages. |

Important Disclosures

The information contained herein has been prepared by NorthCoast Asset Management LLC (“NorthCoast”) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. NorthCoast has not sought to independently verify information obtained from public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by NorthCoast. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of NorthCoast. NorthCoast does not represent, warrant or guarantee that this information is suitable for any investment purpose and it should not be used as a basis for investment decisions. © 2020 NorthCoast Asset Management LLC.

PAST PERFORMANCE DOES NOT GUARANTEE OR INDICATE FUTURE RESULTS.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products or to adopt any investment strategy. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. Performance differences for certain investors may occur due to various factors, including timing of investment. Investment return will fluctuate and may be volatile, especially over short time horizons.

INVESTING ENTAILS RISKS, INCLUDING POSSIBLE LOSS OF SOME OR ALL OF AN INVESTMENT.

The investment views and market opinions/analyses expressed herein may not reflect those of NorthCoast as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties.